One Of My Most Valuable B2B Marketing Secrets

I am surprised by how few B2B tech startups (from my experience, pretty close to zero) leverage industry analysts. I suspect this is due in part to misconceptions, in part to legitimate roadblocks, in part to lack of awareness, in part to underestimated value, and in part to a lack of knowledge about how.

In fact, analysts can provide tremendous value, so let’s address these…

What are Analysts?

Professional industry analysts are individuals or firms that are experts in an area (e.g., industry or function), i.e., subject matter experts (SMEs). Typically, they make money by publishing research and advising clients. They are quite prevalent especially in enterprise information technology (IT) where the landscapes (technologies and vendors) are complex and rapidly changing. Analysts may have experts in a technology area (e.g., databases), vertical industry (e.g., logistics), or function (e.g., marketing).

Companies that buy and use technology products are often looking for selection guidance will pay for analyst research or hire analysts, often by paying an annual fee to a firm for access to its research and pool of analysts.

Vendors that make technology (e.g., software) will court reputable analysts so they get included in their published research and possibly recommended to prospective enterprise customers. If mentioned favorably in research, a vendor may pay additional fees for rights to distribute that research. Vendors may also hire analysts to guide them with their strategy.

Analysts’ clients (users or vendors) can range from enormous enterprises to small startups.

Examples of large analysts in the enterprise IT (information technology) space include Gartner, Forrester, and IDC, but there’s a plethora of others including small boutique firms. Here’re some top analysts and websites to save you from hunting:

- 451 Research

- ABI Research

- Analysys Mason

- Aragon Research

- ARC Advisory Group

- Canalys

- Celent

- Constellation Research

- Digital Clarity Group

- Everest Group

- Forrester Research

- Frost & Sullivan

- Gartner

- GlobalData

- HFS Research

- IDC

- IHS Markit

- Informa Tech

- ISG

- NelsonHall

- Omdia (prev Ovum)

- Parks Associates

- Prophet Altimeter

- Technology Business Research

(Note: This blog post focuses on traditional analysts vs digital/crowdsourced platforms like G2, Owler, etc.)

Example Reports

If you’ve never seen these analyst reports, following are some of the industry’s most famous regularly published reports.

Vendor Landscape Reports

Gartner’s Magic Quadrant (MQ) reports

Conveys the vendor landscape in a specific technology area. The MQ includes a matrix chart illustrating the relative strength of the vendors in the area. Gartner shows vendors who have a complete vision and execute well in the top right quadrant.

Gartner Magic Quadrant: Robotic Process Automation Software, May 2019

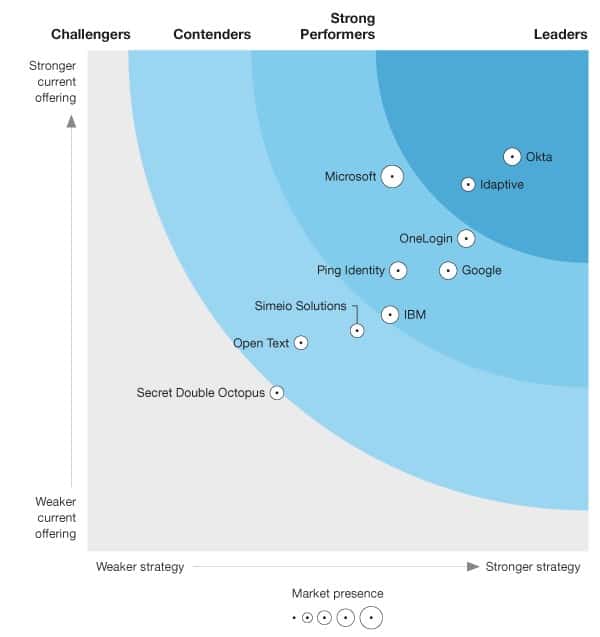

Forrester’s Wave and New Wave reports

Like Gartner’s Magic Quadrant, Forrester uses a “Wave” chart format to show the relative positioning of vendors within a mature market space. Their “New Wave” report focuses on emerging technology spaces. Forrester shows vendors with strong strategy and strong current offering in top right corner.

Forrester Wave: Identity-As-A-Service (IDaaS), Q2 2019

Forrester New Wave™: Automation-Focused Machine Learning Solutions, Q2 2019

Gartner’s Critical Capabilities reports

Gartner’s “Critical Capabilities” reports are helpful for seeing what functional capabilities and use cases are important to customers within an IT category. Even if you are targeting non-enterprise B2B (e.g., SMB or mid-market), I’d recommend looking at these reports (or at least the free summaries) for an idea of the capabilities (functionality) and use cases that Gartner’s clients (mostly enterprises) think are important to them.

Market Landscape Reports

Some analysts give broader views of a market. One of the most famous is Gartner’s Hype Cycle. These can be useful to see where your space might be within the (at least the perceived) customer adoption phase.

Gartner’s Hype Cycle

Gartner Hype Cycle: Emerging Technologies 2019

Forrester used to do similar reports called “TechRadar”.

A lot of time, effort, and collective knowledge goes into creating these reports. Do not expect them for free. However, even the summary outlines can be helpful. To get a sense of the breadth of research and to find specific categories, reports or analysts, you can find:

- a list of Gartner’s Magic Quadrants and Critical Capabilities here: https://www.gartner.com/en/research/magic-quadrant and

- a list of Forrester Research’s Coverage Areas here: https://www.forrester.com/topics.

Misconceptions & Value

As CEO, CMO, and SME (subject matter expert), I’ve worked with many analysts over the years when I was at large companies like Microsoft, and even more so at startups both as a paid client and not. I can tell you that I/we got tremendous value.

I’ve heard criticisms like “analysts don’t necessarily really know what’s going on”, or “it’s pay to play” (i.e., you’re more likely to get covered/mentioned if you’re a paying client). Whether you believe analysts are knowledgeable or not, many others (customers, partners, acquirers) do believe, listen, and give credence to what analysts say. And analysts know that their value is compromised if they don’t appear to be impartial, so they typically strive to avoid violating that trust.

Startups have limited resources; thus, resource leverage is key. Analysts talk to many companies (customers and vendors), so speaking to one analyst can be like speaking to many target companies at once. Consequently, analysts can be a powerful amplifier for both gaining insights and amplifying awareness.

Insights

You can learn from analysts in many ways. For example, …

- Analysts can help you validate your assumptions. Afterall, a startup is a business based on assumptions that need validation.

- Analysts can help you discover and provide insights about competitors, markets, use case, buying processes, segments, GTM (see my recent post re [relevant “Covid Pivot”].

Awareness

Analysts can provide a free avenue for broad and/or targeted exposure. For example, …

- Analysts can include you in research publications. “But only larger established vendors get included in Magic Quadrants.” That is true…partially. Analysts will often tell you what the minimum criteria is for inclusion in a report like a Gartner Magic Quadrant (e.g., minimum revenue, or minimum number of customers). However, the report may have (as Gartner MQs usually do) a section within the larger report for upcoming companies that do not meet the minimum criteria. For example, in 2011, I was proud when Qontext was selected as a “Cool Vendor in Context-Aware Computing”. I put considerable effort into getting that selection and it helped us a lot, almost certainly aiding in our successful acquisition by AutoDesk (NASDAQ: ADSK) the following year. I still have the poster board tradeshow plaque.

- Analysts might mention you in their conversations to potential customers, partners, and yes even potential acquirers! Analysts may recommend you unsolicited, or clients may actively ask analysts for recommendations. Either way, analysts cannot recommend you if they do not even know about you.

Analysts cannot recommend you if they do not even know about you.

How To Leverage Analysts

Analysts make money from their expertise, usually by selling published research or by selling their time via advising and consulting. But how do they become “experts”? Experience is a huge factor in building up their base, but they also need to stay current.

One important method to stay current is by taking “vendor briefings” where a vendor will introduce themselves to the analyst or update the analyst with their latest progress or news. Of course, analysts have limited time; plus, their time is money, so they cannot take every briefing request. However, if your space is relevant to the specific analyst(s), or if your approach and traction is unique or interesting enough, then the analyst is likely to accept your briefing request.

1. Find Right Analyst

The best way to find the right analyst is to find analysts that write about your space. In enterprise IT, Gartner, Forrester Research, and IDC are examples of large enterprise IT firms. Gartner, for example, is a public company (NYSE: IT) with over 15,000 employees and $4B in annual revenue. Forrester Research is also public (NASDAQ: FORR) with about 1,500 employees and $300M in revenue. There are lots of great smaller analyst firms, even analysts operating individually. I refer to these big analysts as examples, but feel free to consider other analysts too; just keep in mind the level of “amplification” or leverage you get (e.g., insights and awareness).

For example, you can find reports by your topic:

- By Gartner analysts, here: https://www.gartner.com/en/research/magic-quadrant

- By Forrester analysts, here: https://www.forrester.com/topics

A. Find relevant reports, e.g., if you operate in the “Ad Tech” space:

B. Open the report summaries and note down the analysts who authored the reports, e.g.,:As you review more relevant report summaries by an analyst firm, you will get a sense of which individual analysts are most focused on your relevant spaces. Make sure to build a comprehensive list of analysts by exploring reports by different dimensions (e.g., industry, function, or technology).

2. Request A Briefing

Now that you have identified the expert analysts in your field, you are ready to request a vendor briefing.

You start the process by requesting a briefing. Each analyst or firm will have its own process. For big firms like Gartner or Forrester, you either send an email to a specific briefing request address or simply complete an online form. For example, here the request forms for Gartner and Forrester:

- Gartner: https://www.gartner.com/en/contact/vendor-briefings

- Forrester: https://go.forrester.com/analyst-briefing/

They are not obligated to meet with you, so your request must pique their interest. Do not make your briefing request too salesy; although, it is fine to simply say that you would like to introduce your company. However, you need to rise above all the other companies that want to introduce themselves. How is your approach or solution different and important? Even better, hint at what can you teach them.

Ask to brief specific analysts by name. You can also ask them to suggest whom to brief, but this does leave the door open for them to possibly suggest a less relevant or less influential analyst than the analyst(s) you wanted.

Be sure to specify that your preference is to meet sooner rather than trying to coordinate all the requested analysts. Analysts have full schedules. Finding an available time common to multiple analysts might delay your briefing for months. It may take more of your time but offer to brief each analyst individually. That way, not only will you get your value sooner, but a) you are less likely to miss deadlines (e.g., for report publications or events), and b) alone, the analyst may be more open with you.

Usually, you can provide the conference call or virtual meeting details or sometimes you have the option to use theirs.

3. Execute The Briefing

There are often exceptions to any rule, but usually, vendor briefings are held as remote virtual meetings or phone calls. In some cases, they may be in-person. Duration is usually 30-60 minutes. If/when you receive confirmation, note the allocated duration and prepare accordingly.

If this is your first briefing with the analyst, I highly recommend that you prepare a deck. Don’t just use your existing customer or investor decks (you have different versions, right?). Of course, it’s okay to reuse slides, but customize a deck for the briefing.

Remember, analysts survive by charging clients for their advice. This briefing is free because it is intended to be one-way: You inform, or brief, the analyst. If you start off with all questions blazing, you will surely signal your naivete, probably get politely reprimanded, and the analyst will then completely close to questions.

You should first strive to educate the analyst, so they know you, your unique advantages and for whom, and what you want. For example, at Qontext, I made sure to research in which analyst’s category we fit (e.g., at Gartner, they called our space “Context-Aware Computing”). I made sure to communicate to the analysts with whom we primarily competed (Yammer and Salesforce Chatter) and how we differentiated (Yammer did not integrate inside apps; Chatter only integrated inside Salesforce; we integrated inside any SaaS app). And thus, I made sure they knew we were seeking SaaS companies (especially Salesforce competitors) with whom to partner.

Be careful, however. Do not disclose key confidential information you do not want in competitor’s hands. Analysts are unlikely to sign an NDA and are likely to share your info internally; even if they anonymize your info, concepts might get shared with clients, one of whom could be a current or future competitor. But remember, even if you are doing something unique it does not mean anyone who learns of it will both believe it’s important and execute on it properly.

The good news is that you can usually still get some valuable feedback. Briefings are supposed to be one-way, but you can learn a lot by the clarifying questions analysts ask. And analysts are people. If you spend your time providing valuable insights, only the hardest of people will deny answering any question. Besides, analysts are motivated to attract startup briefings so they can stay current with the cutting edge. But, again, they are unlikely to answer many questions, so have your questions prioritized and ration them in gradually as you go. IMHO, savvy analyst feedback on one assumption can easily make your 1-hour briefing worthwhile.

Asks

Here are legitimate things you can ask from an analyst in a briefing:

- Questions: As discussed above, have one, maybe a few questions you hope to get answered.

- Publications: Are there any upcoming publications (e.g., research reports) in which you might be included? What are the deadlines and requirements?

- Other Analysts: Whom else at the firm should you brief?

- Company Introductions: First, what companies should you be speaking to (e.g., customer or partner prospects), either specifically or generically?

Herein, I’ve shared some ways to get value without spending much money. In many cases, you can get even more value by paying analysts – buy reports, hire for one-off engagements (e.g., speaking, consults, writing), or ongoing consulting. Some bigger analysts may offer special pricing for startups — it doesn’t hurt to ask. At Qontext, even as a startup, we got so much value out of analysts, we hired multiple analysts. In our case, I do not doubt that our successful acquisition was helped by the wonderful value we received from analysts.

[…] Analyst Relations. In some B2B spaces, analysts can be important for making recommendations to potential customers. For all the advantages of this strategy, I recommend Samir Ghosh’s article on how to leverage analysts for B2B marketing. […]